The Global Education Office is trying to convince international students to purchase the UNM Student Insurance Plan to avoid heavy medical bills in case of emergencies or serious accidents. But the more expensive plan has been a hard sell, according to GEO officials.

Most native New Mexican students have signed up for the state’s expanded Medicaid health insurance plan, but international students, who may be here from a few years to just a few semesters, do not qualify for Medicaid. And if they don’t pay for a policy in time, they receive a hold on their accounts.

According to the University’s rules, international students must either buy UNM health insurance or opt out of UNM insurance and buy a certain minimum amount of coverage from an outside insurer, according to UNM’s website.

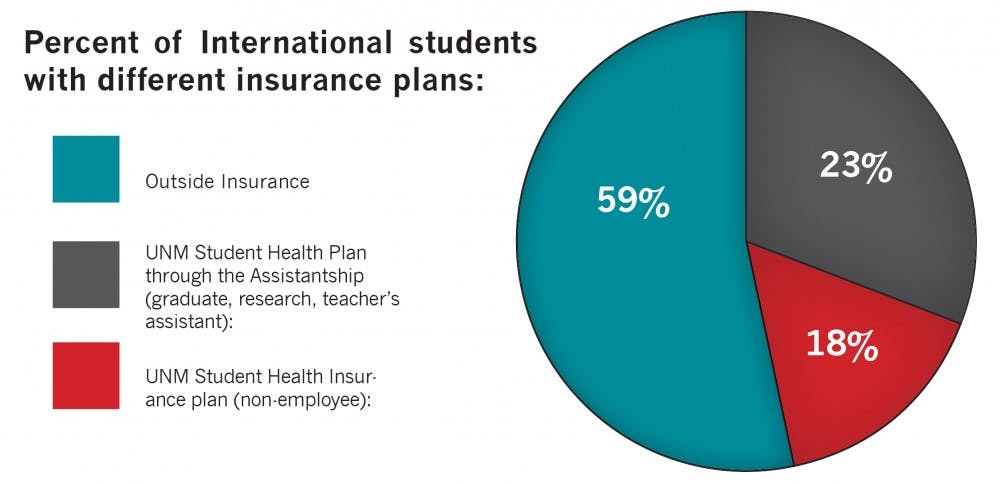

However, the majority of the international students — around 60 percent — opt for the cheaper plans. These plans can be much more affordable, but in the event of an emergency the students may end up paying heavy medical bills, because the cheaper plans do not cover many things and have much higher deductibles, according to the GEO officials.

“Everybody is trying to get out of the UNM insurance policy,” said Linda Melville, associate director at the Global Education Office. “They do not want to spend $1,500 a year to buy the UNM plan; they are buying these cheaper non-UNM health insurance plans that are short-term and international that meet the minimum requirements of the University.”

The minimum health insurance requirement is coverage of $100,000 per accident or illness and $25,000 for repatriation, according to UNM’s website.

“People are being very short-sighted and saying, ‘I am not sick now and I am probably not going to get sick,’” Melville said. “They do not understand how health care is in the U.S. despite our explanations at the orientation — that it is really expensive if you get sick.”

Students are opting instead for insurers like COMPASS Silver Student Medical Insurance and International Student Insurance: plans that start as low as $300 for 10 months, depending on the age of the student. In comparison, UNM’s insurance plan costs $1,444 for two semesters, regardless of the student’s age.

Hafiz Ahmad Yar, a Ph.D. student of educational linguistics, signed up for one of the cheaper insurance policies last year.

“UNM’s policy was a lot more expensive. Therefore, after consultation with friends, I bought a cheaper outside insurance policy,” Yar said.

However, Yar realized his mistake after he fell ill.

Get content from The Daily Lobo delivered to your inbox

“I had to go through a lot of medical tests and medication, and my insurer paid almost nothing back,” he said.

Yar said he had to spend all of his savings on minor stomach and dental problems.

Student Health Center officials performed investigations to find out whether they needed help with enrolling people in the state insurance plans. They found out that almost all of the incoming local students qualified for Medicaid.

“Local students do not have the same issues,” Melville said. “If the local students get an emergency problem and they have not signed up for the Medicaid, they can be seen under the emergency medical services provisions of Medicaid.”

She said that students have to be adults and review all of the information before making any decisions.

A major contributing factor is that the majority of incoming international students are from countries where medical systems are socialized, she said.

“They cannot comprehend what we tell them; they cannot believe that medical care is really expensive in the U.S.,” Melville said. “They cannot believe it until it happens.”

Healthcare in the United States has become more and more expensive, and is becoming increasingly complicated thanks to new laws, she said.

Choosing a health insurance policy becomes even more difficult for international students when they have dependents.

The UNM Health Student Insurance Policy for students with dependents is “pretty expensive,” Melville said.

It costs students an additional $4,518 to add a spouse and $1,928 to add a child to the policy, according to the GEO’s website.

“The reason for that is because the healthcare is expensive in the U.S. and spouses tend to do things like have babies, so the insurance company has the cost aligned with that,” Melville said.

GEO officials understand that most students cannot afford to have their dependents on the UNM policy, she said.

Yar said one of his fellow international students bought a cheaper insurance policy for himself and his wife. The couple went bankrupt after delivering a baby, he said.

“They got a bill of more than $8,000 and the insurance company hardly reimbursed any money,” he said.

Melville said that New Mexico offers Medicaid to the pregnant spouses and children of international students. However, the majority of international students and even healthcare providers in the state are unaware of this rule.

“Most healthcare providers do not know that dependents of international students can get Medicaid if they are under the age of 19 or pregnant, and are here on a visa,” Melville said.

GEO recommends that international students who are coming with their families go to the New Mexico State Health Insurance website and buy an insurance policy there.

Sayyed Shah is the assistant news editor at the Daily Lobo and Jonathan Baca is the news editor. They can be contacted at news @dailylobo.com or on Twitter @DailyLobo.